Our customs clearance team is available to provide professional and advance customer service through electronic paperless systems as well as tax deduction service through various bank e-payment systems.

We also provide cross border service / 19 BIS / BOI / Duty compensation / IEAT free zone (EPZ zone) / Bonded warehouse and Free zone.

List A , List F

List A and List F

List A and List F are the status of goods that the customs system will inspect and lock. Goods that have been in a customs custody for more than 45 days from the date of importation. Without submitting a declaration or without paying duty or depositing a deposit of duty charged by Customs. cannot send data electronically We therefore collect the laws and procedures of various agencies related to residues. for use in understanding and used as a guideline to solve problems in such matters as follows :

According to the Customs Department Announcement No. 142/2560 on Customs Procedures on Residues, the meanings and criteria are defined as follows:

“Residual goods” means goods which are in a customs custody in any of the following manners:

1. Imported goods that are Dangerous goods according to the type or type specified in Section 5 (5) of the Customs Act B.E. 2560 that the importer has not taken the goods out of the customs area within 5 days (OVERSIDE) and within 7 days for other cases since the dangerous goods are in the custody of Customs.

2. Imported goods other than (1) that have been in a customs custody for more than 30 days from the date of importation. without submitting a goods declaration and did not pay the duty or place a guarantee for the duty that should be collected on such goods which the Director-General sends a letter to the agent of the ship importing the goods but the ship’s representative refuses to take corrective action within 15 days from the date of receipt of the notification from the Director-General

3. Imported goods other than those mentioned in (1) where the goods declaration is submitted and paying duty or the deposit of duty insurance is not complete. and not taken out of a customs custody within 30 days from the date of receipt of a written notification from the Director-General.

4. Fresh and waste products that have not been surrendered from the custody of the Customs and apparently spoiled or spoiled according to Section 109 of the Customs Act B.E. 2560

How many days until List A and List F are installed?

Before being posted on List F, our products will be listed as List A first, that is, from the date the ship arrives at the port for more than 30 days, our products will be counted as List A, and within 15 days after being posted as A status, the goods have not been picked up. will be listed as List F, in summary, 45 daysอ 45 วัน

If List F is attached, the product will be confiscated and sold at auction.

If you are on List F, then it is equivalent to waiting for the product to be auctioned. But in the meantime, you can still make a request for contacting to receive the product. or until the product is sold to the public auction

Exemption from customs clearance for residual goods

Criteria for Exemption from Customs Clearance for Overdue Goods

1. Any imported goods that are left over If the importer wishes to go through customs clearance Submit a request for a waiver to pass through the customs clearance of residual goods. according to the attachment to the customs office or customs house for approval before submitting the goods declaration

2. Approval of relief for customs clearance under (1) can be granted only in the following cases

2.1 It is goods that the importer wishes to pay duties and other taxes and duties of all types. Other taxes and duties of all types in full first and then request a duty refund later

2.2 The goods are exempt from duty under Part 4 of the Royal Decree. Customs Tariff Act B.E. 2530

2.3 Belonging to the investment promotion law that has complied with the rules and conditions specified in the provisions of that law.

3. Residual goods that have been granted clearance for customs clearance pursuant to (1) are required to be completed by the importer within 15 working days for general residues and within 3 working days for consignment. residues that are dangerous goods under Section 5 (5) of the Customs Act B.E. 2560 from the date of waiver

4. After the expiration of the grace period under (3) for general residues If the importer has a necessity and submits a request for a second extension of time for customs clearance, if there is a reasonable cause, the final extension of time can be granted for another 15 working days. Dangerous goods under Section 5 (5) of the Customs Act B.E. 2560 are not allowed to waive.

5. In case of non-compliance with items (1) – (4), the customs officer will propose to the director of the customs office or the master of the customs office for approval.

Relief from customs clearance incase an auction has already been announced

1. Residual goods that have reached the stage of being sold by auction but cannot be sold. or has not yet been approved to deliver to government agencies government educational institution or any charitable organization If the importer has submitted a request for a waiver Customs office or customs house will consider a waiver in accordance with the criteria set forth above

2. Importers must submit a request not less than 3 days before the scheduled auction date.

3. Importers must place a deposit of 25% of the assessed duty and other taxes and duties. For goods that are not subject to duty payment under Part 2 of the Customs Tariff Decree B.E. When the importer has already deposited the deposit The customs officer in charge of the residual agency records the insurance receipt number in the request for waiver. And the importer must present evidence of payment of duties and other types of taxes and duties together with the goods entry within 3 working days from the end of the grace period. If the importer fails to complete the customs formalities within 3 working days from the date of waiver approval The responsible customs officer will inform the accounting and taxation unit to reimburse the security deposit as state revenue.

Application form for a waiver to pass through the customs clearance of residual goods according to the announcement

#logistics #lynxgistics #import #export #List A #List F #ศุลกากร #ThaiCustoms

ref :

https://ecs-support.github.io/knowledge-center/customs-clearance/docs/import/overtime-goods/

http://www.ratchakitcha.soc.go.th/DATA/PDF/2560/E/276/56.PDF

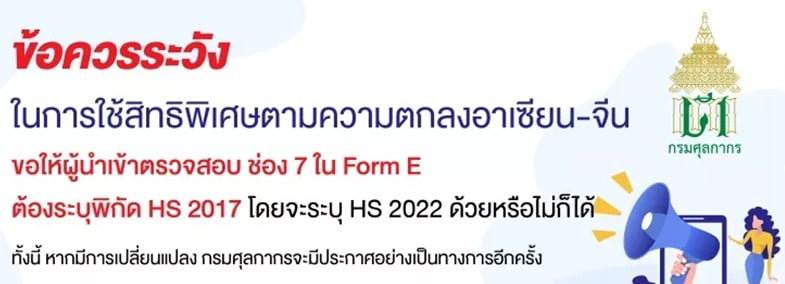

7 Precautions for Using Special Preferential Benefits under the ASEAN-China Agreement Content

Importers must check whether the country of origin of the product is entitled to a duty reduction privilege or not.

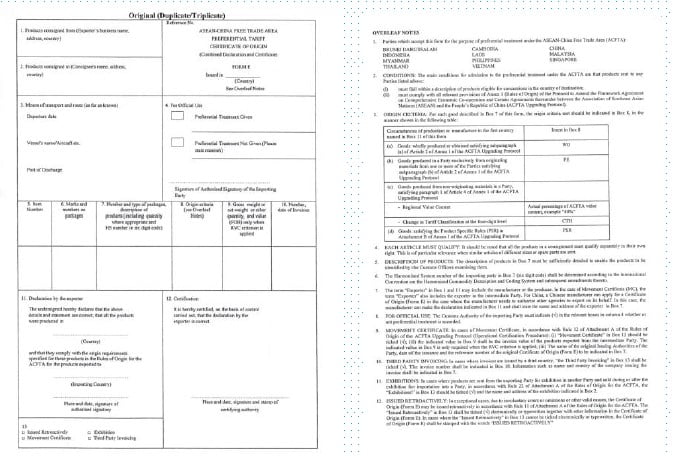

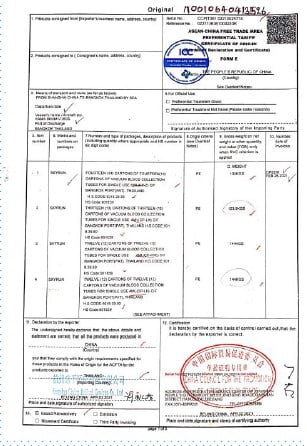

Certificate of Origin (Form E) that does not contain overleaf notes or is printed on a separate sheet from the Form E is invalid. Must have overleaf notes printed on the same sheet as Form E on all pages.

Certificate of Origin (Form E) must be printed in color only. If printed in black and white, it cannot be used.

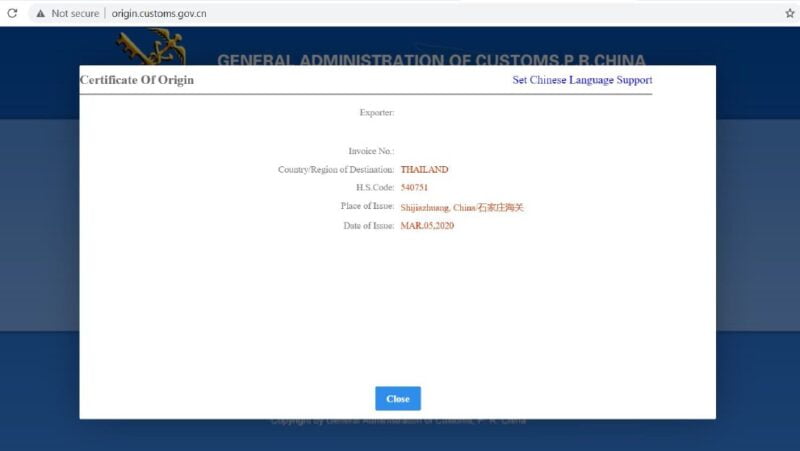

Certificate of Origin (Form E) benefit users are required to check whether it was issued by a valid authority by checking http://ongin.customs.gov.cn for Form E issued by Customs of People’s Republic of China and http://checkccpiteco.net for Form E issued by CHINA COUNCIL FOR THE PROMOTION OF INTERNATIONAL TRADE: CCPIT.

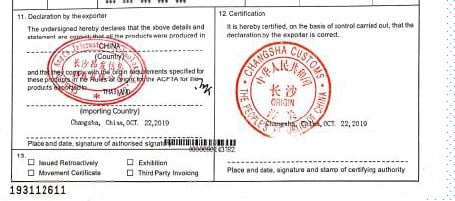

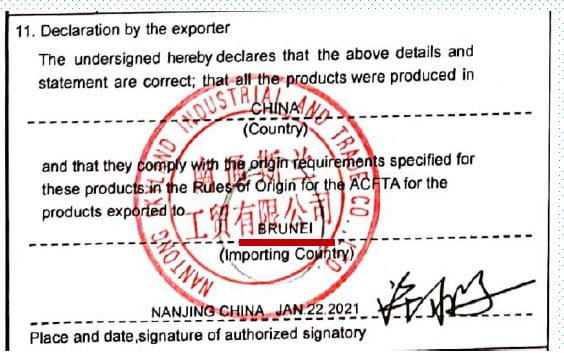

Certificate of Origin (Form E), box 11 and 12 must be signed and stamped on all pages.

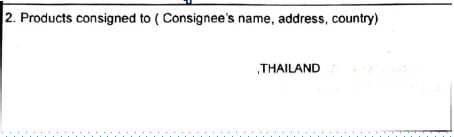

Certificate of Origin (Form E), box 11, check whether the importing country matches box 2 or not.

The Tariff specified in the Certificate of Origin (Form E) shall be the 2017 Harmonized Tariff in the 6-digit level of the importing Party if the Form E submitted by China references the 2022 Tariff will not be able to use the right to reduce duty according to the agreement

#logistics #lynxgistics #import #export #forme #hscode #ฟอร์มอี

ref : https://www.customs.go.th/cont_strc_simple_with_date.php?current_id=142329324148505f48464a4e464b46

What is RE-EXPORT ?

Re-Export means goods that have been imported into the Kingdom. The importer wants to export to another country, without changing any shape or appearance or goods imported as consumables for vehicles traveling abroad for the benefit of customs in controlling and generating income from exported or imported goods. In this regard, 9 out of 10 of the already paid import duty can be refunded or the amount exceeding 1,000 baht of the amount collected. Calculated according to each export declaration with the following conditions :

- goods must be in the original imported condition.

- must be re-exported within 1 year from the date of importation.

Formalities for exporting goods.

- Goods exported that can be refunded must be in the same condition as they were imported. If it is necessary to change the packaging or container or must declare the number new mark The officer will consider the exporter’s request. and notify the customs clearance agency that imported goods send officials to control changes according to such wishes.

- Attaching the sample to the original declaration Any exported goods that can be attached with the original export declaration, such as cloth, paper, plastic, etc., the exporter shall attach all kinds of samples according to the list of goods and prices. Other documents attached to the export declaration The exporter must certify that it is a sample from the actual exported product and have the officials sign it as well.

- The exporter must submit a request showing reasons for re-export by applying for the duty payment rights of Re-export together with the goods declaration.

- If the exporter sends the goods out of the same port as the import, such as importing through Bangkok Port and exporting through Bangkok Port Pay only 1/10 of the import duty, but not more than 1,000 baht.

- If the exporter sends the goods through another port which is not the port of import, such as importing at Bangkok Port but exported at Laem Chabang Port All taxes and duties must be paid in full first. After having sent the goods back, he then requested a refund of 9 out of 10 of the duty.

*** However, it must be proven that it is the same item imported into the Kingdom. and such items must not be utilized during their stay in the Kingdom except for the use of such goods for sending back out of the Kingdom and did not change its condition or the nature of that thing The duty refund request must be submitted within 6 months from the date of return. According to Section 28 of the Customs Act B.E. 2560 ***

Scope of control

Goods produced or originating in foreign countries can be re-export out of the Kingdom according to the following condition:

RE-EXPORT products generally can be exported freely. Except for products subject to export control measures of the Ministry of Commerce, such as Graven image and Buddha images, nutmeg, sugar, pearl oysters and other products. live tiger prawns cassava, rice, etc. and Products that the Ministry of Commerce has certified to the sending country that they will not be re-exported out of the Kingdom (RE-EXPORT) to a third country again for prevent destruction of the natural environment and for national security. unless permitted by the Minister of Commerce or the person assigned by the Minister of Commerce.

Types of re-export can be divided into 2 types

- Goods in customs custody have not yet completed the duty and tax payment formalities. and has not yet been released from the custody of the customs.

- Goods outside customs custody are goods that have completed and correct the duty and tax payment formalities and have been inspected and released from customs custody.

which the period for requesting a general duty refund in the case of imported goods that have been returned (Re-Export), the importer must file a request for a return within 6 months from the date of re-exporting the goods out of the Kingdom.

#Lynxgistics #import #export #logistics #freightforwarder #reexport

Types of Preferential Certificates of Origin

Preferential Certificate of Origin is a document issued to an exporter by the Department of Foreign Trade. For certifying that the goods in a specific export shipment originated in Thailand and were produced in accordance with the rules of origin, because many countries use trade barriers, it is necessary to show which country the goods were exported or manufactured in when importing. And importer can apply for an exemption or reduce import duty.

FORM A

This certificate is used to obtain tariff discounts or exemption to the following countries: European Union, the United States, Japan, Canada, Russia, Turkey, Switzerland, and Norway.

FORM D

This certificate is used to obtain tariff discounts or exemption to the following ASEAN member countries: Brunei, Indonesia, Thailand, Malaysia, Philippines, Singapore, Vietnam, Myanmar, Laos, and Cambodia.

FORM GSTP

This certificate is used to obtain tariff discounts or exemption to the following developing countries: Algeria, Argentina, Bangladesh, Benin, Bolivia, Brazil, Cameroon, Chile, Cuba, the Democratic People’s Republic of Korea, Ecuador, Egypt, Ghana, Guinea, Guyana, India, Indonesia, the Islamic Republic of Iran, Iraq, Libya, Malaysia, Mexico, Morocco, Mozambique, Myanmar, Nicaragua, Nigeria, Pakistan, Peru, Philippines, Republic of Korea, Singapore, Sri Lanka, Sudan, Thailand, Trinidad and Tobago, Tunisia, the United Republic of Tanzania, Venezuela, Viet Nam, Zimbabwe, and Mercosur (South American trade bloc incl. Argentina, Brazil, Paraguay and Uruguay).

FORM E

This certificate is used to obtain tariff discounts or exemption to the following ASEAN-CHINA free trade area member countries: Brunei, Indonesia, Thailand, Malaysia, Philippines, Singapore, Vietnam, Myanmar, Laos, Cambodia, and China.

FORM JTEPA

This certificate is used to obtain tariff discounts or exemption to the following countries: Thai and Japan.

FORM AJ

This certificate is used to obtain tariff discounts or exemption to the following ASEAN-JAPAN free trade area member countries: Brunei, Indonesia, Thailand, Malaysia, Philippines, Singapore, Vietnam, Myanmar, Laos, Cambodia, and Japan.

FORM AI

This certificate is used to obtain tariff discounts or exemption to the following ASEAN-INDIA free trade area member countries: Brunei, Indonesia, Thailand, Malaysia, Philippines, Singapore, Vietnam, Myanmar, Laos, Cambodia, and India.

FORM AANZ

This certificate is used to obtain tariff discounts or exemption to the following ASEAN-Australia New Zealand free trade area member countries: Brunei, Indonesia, Thailand, Malaysia, Philippines, Singapore, Vietnam, Myanmar, Laos, Cambodia, Australia, and New Zealand.

FORM TP

This certificate is used to obtain tariff discounts or exemption to the following countries: Thai and Peru.

FORM AK

This certificate is used to obtain tariff discounts or exemption to the following ASEAN-KOREA free trade area member countries: Brunei, Indonesia, Thailand, Malaysia, Philippines, Singapore, Vietnam, Myanmar, Laos, Cambodia, and Korea.

FORM TC

This certificate is used to obtain tariff discounts or exemption to the following countries: Thai and Chile.

FORM AHK

This certificate is used to obtain tariff discounts or exemption to the following ASEAN- Hongkong free trade area member countries: Brunei, Indonesia, Thailand, Malaysia, Philippines, Singapore, Vietnam, Myanmar, Laos, Cambodia, and Hongkong(China).

Ref : Website of Department of foreign trade (www.dft.go.th)