1. What is INCOTERMS?

: You can check out this clip to learn about INCOTERMS

2. What is a phytosanitary certificate?

: A phytosanitary certificate is a document to be issued only by a public officer who is technically qualified and duly authorized by an NPPO of the exporting country that certifies that a plant or plant-based product is free of insects and pests and meets the requirements of the destination country.Therefore, the phytosanitary certificate is regarded as one of the most important documents in the import-export process

3.What you should know before booking space wih carriers

: pls prepare below info before request booking

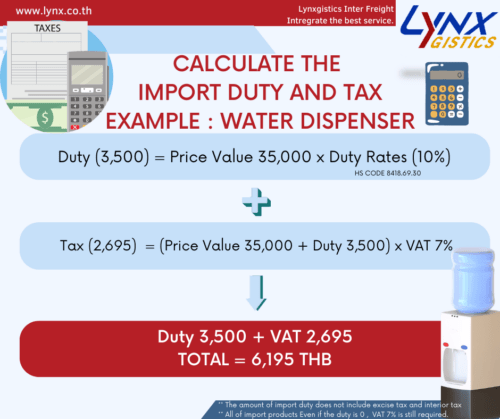

4. How to calculate the import duty and tax ?

: The tax that you must pay when import the goods is import duty and VAT but some kind of goods will include excise tax and interior tax.

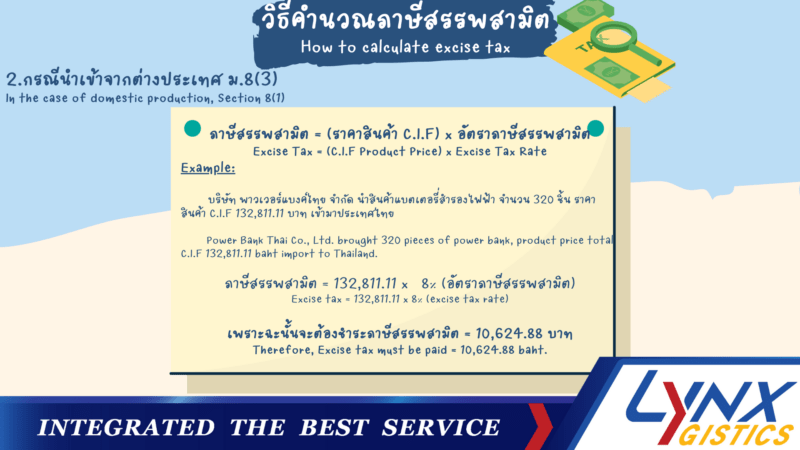

5.Excise tax calculation methods In case of importing from foreign countries, Section 8(3)

Importers are obligated to pay taxes at the specified rate. By calculating the excise tax as follows:

Excise Tax = (C.I.F Product Price) x Excise Tax Rate

6. Goods and Services subject to excise tax collection

Excise tax collection in Thailand It is a specific sales tax levied on certain goods and services. The objective is to allow consumers to bear higher tax burdens than usual. for products that may have a negative effect on consumer health or morals or products that look extravagant or goods that receive special benefits from the state or goods that cause a burden on the government to build various facilities to provide services to consumers or as a product that causes an impact on the environment

Goods and services that the Excise Department collects excise taxes are goods that the government wants to control consumption. Due to the nature that causes negative effects on health or affects the morals of the people. or looks like a luxury product or as goods and services that receive special benefits from state affairs which include the following products

Oil and oil products

Petroleum products include gasoline, kerosene, jet fuel, diesel, heavy fuel, fuel oil and other oils that is similar to the oil that has already been named

Beverage

Beverage According to the Excise Tax Act, B.E. 2560, beverage means something that is normally consumed as a beverage. Without additives, which are non-alcoholic or alcoholic. not more than 0.5% by volume, packed in containers and sealed but not as deep as water or natural mineral water Distilled or filtered water for drinking Without flavoring, fresh milk, other milk as specified in the law on food. Beverages that the manufacturer has produced for retail sales exclusively do not contain carbon dioxide.

Electrical appliances

Electrical appliances mean products that use electrical energy. and shall also include anything used in conjunction with electricity or relating to electricity such as air conditioners with cooling capacity not exceeding 72,000 BTU per hour and other electric lamps and chandeliers for ceiling or wall mounting. but does not include those used for Illumination for outdoor public spaces or highways.

Crystal lake glass and other crystal glass

Glass and glassware means articles and utensils made of glass such as glass, lead crystal and other crystal glass.

Cars (passenger cars, pick-up trucks, passenger cars with no more than 10 seats)

Motor vehicle, vehicle with three or more wheels and running on engine power, electric power, or other power but does not include vehicles that travel on rails motorcycles with sidecars of not more than 1 wheel, motorcycles under the law on cars and vehicles announced by the Minister.

Passenger car means a sedan or automobile designed for regular use. and shall include a vehicle in the same manner such as a vehicle with a homogeneous roof in a permanent manner on the side or behind the driver there is a door or window and a seat. regardless of how many seats there are

Pick-up truck means a vehicle that has the back as a pick-up truck. which is open to the rear of the car without a roof designed for vehicle weight total weight not exceeding 4,000 kg.

Passenger vehicle means a van or vehicle designed to transport a large number of passengers. as well as similar vehicles with seating for not more than 10 people.

Yachts and recreational water vehicles

such as Boats, yachts and all kinds of water vehicles

Perfume

perfume oil and fragrance oil. Aromatic products means perfumes, perfume oils, perfumed oils, and other aromatic substances, but excluding perfume oils that can be used exclusively for manufacturing products.

Carpets and other floor coverings (Only made of fur)

Carpets and other floor coverings Only made of fur means that the ramps are made of various materials. and textile products. It is a piece of fabric that contains 1 or more layers of woven material for the benefit of use. like a matting machine and general floor coverings and includes articles that resemble carpets and floor coverings but intended to be used for other purposes

Motorcycle

a vehicle with no more than two wheels. If there is a side trailer, there is not more than one additional wheel. Walking with engine power or electric power and shall include motorcycles according to the law on cars

Battery

a cell or a group of electrical cells connected in series or parallel or both and capable of storing energy and providing electrical energy.

Entertainment or leisure business

the business operation in terms of entertainment or recreation in service places for the purpose of earn money as a business such as theatrical venues, movie venues, nightclubs, cabarets, discotheques, karaoke, cocktail lounges, a place to bathe or steam and massage etc.

Gambling business

the business operation in the area of providing gambling by any means. In order to receive prize money or other benefits such as horse races, government lottery, etc.

Businesses that receive concessions from the state.

It means that any business in the form of providing services to the general public with permission or concessions from the state to operate, such as telecommunications, etc.

Liquor

All objects or mixtures containing alcoholic beverages that are consumed. as well as liquor or inedible water. But when mixed with water or other liquids, it can be drunk and eaten just like liquor. Soaked liquor means undistilled liquor and shall include fermented liquor mixed with liquor but there is also a strong alcohol of no more than fifteen degrees as well, such as beer, wine, etc.

Tobacco

Tobacco leaves or compressed tobacco that have been cut into strips and dried.

Playing cards

According to the Playing Cards Act, BE 2486, Section 4, means playing cards made of paper or leather or made of other objects as prescribed in the Ministerial Regulations, and in Section 7, no person shall make playing cards or bring in playing cards. unless authorized by the Director-General, and in Section 7, no person shall sell playing cards in trade unless authorized by the Official In issuing a license, the applicant must pay a fee as prescribed in the Ministerial Regulation.At present, tax is only collected on imported playing cards. Importers must bring excise stamped playing cards and pay a fee of not more than 30 percent depending on the type and object made, and put the stamp on the envelope of the playing card that has been paid.

For playing cards produced within the country, there is no tax collection because the playing card factory is a state-owned enterprise. under the Excise Department will be the sole monopoly on the production of playing cards

REF

https://webdev.excise.go.th/aec-law/th/excise-th-thailand.php

https://ms.udru.ac.th/FNresearch/assets/pdf/ch15.pdf

http://bta.excise.go.th/calculate_tax_car.php?calculate_id=0002